Creditworthy, by Josh Lauer.

Since the consumer credit reporting agency Equifax revealed on September 7th that the personal information of 143 million Americans had been compromised in an attack by hackers, leaving more than forty percent of the population vulnerable to identity theft and damaged credit scores, questions about the responsibilities and accountability of the credit bureaus, the fairness of the credit rating system, and the vulnerability of consumers’ data have reached a new level of urgency. While Equifax has been widely criticized for its incompetent, and maybe even criminal, response to a disaster that quite possibly could have been prevented, what is at issue are not just the security practices and corporate ethics of a single company, but also, more generally, the structure and viability of the credit rating system itself.

No one is in a better position to help us make sense of how the Equifax breach fits into the history of American capitalism than Josh Lauer, associate professor of media studies at the University of New Hampshire. His book, Creditworthy: A History of Consumer Surveillance and Financial Identity in America, which was published in July, is the first to tell the story of credit reporting in the United States, tracing its evolution from its 19th century beginnings to the regime of commercial surveillance and algorithmic calculation that tracks us today.

Adam Webb-Orenstein: In your book, you show that with the emergence of the credit bureaus in the 19th century, a commercial surveillance network formed that was vaster than anything comparable in the public sector. Today, the collection of our personal information for private business is probably more consequential to most of our lives than anything the intelligence agencies are doing. For institutions that have been so important to consumption and enterprise in the United States, the credit bureaus have not received much scholarly attention, while there has been a lot of research done on state surveillance. Why do you think this is?

Josh Lauer: It’s pretty typical for people to focus on the state, with good reason. The stakes are different with state surveillance. The state can arrest you, can put you in jail, can kill you. Credit bureaus can’t kill you, not yet.

There’s another reason why there hasn’t been a lot of research on the credit bureaus: there’s no archive. I think plenty of scholars would have been happy to study them. It’s just that the data wasn’t there or wasn’t easily defined.

AWO: Since that’s the case, how did you arrive at this project? How did you decide to study the history of this particular industry?

JL: I was like you: I thought “this seems to be an important institution, it affects a lot of our lives, and they have so much of our information. How can there not be a history?” So I went looking around for accounts of the history of credit bureaus. There weren’t any. That’s how I came upon this project.

It was a very hard institution to study. I was looking through trade press and looking for old instructional guides and newspapers. It took a lot of time to follow a lot of different kinds of sources. They were not laid out to study. Not that anyone has a project where everything’s laid out perfectly, but there’s no archive of credit bureau files to look through.

The fact that I can study it has a lot to do with all the full-text databases that exist now. I’m able to put keywords into searches through old newspapers and trade publications. If I’d had to look through every old newspaper in the country, I couldn’t have done it. So some of it was just the lucky timing of being a scholar in the 21st century.

AWO: I’m curious about your research process. How did you go about assembling this archive?

JL: Well, as I started figuring out what the keywords were, I could start to do more targeted searches in special collections—in WorldCat, for example—and I was able to locate some early credit rating books for consumers, not for business people, but for consumers. And then once I found some of those sources, I could actually go to the Library of Congress and start to find examples to look at. The trade press was super important. There were a couple of key publications that gave me the history. It wasn’t all correct but, it at least gave me a look inside the world of these institutions as they were developing in the early part of the 20th century.

These sources were there, but if I hadn’t known the keywords to looks for, then it would have been hard to actually start piecing together the story. And it’s a complicated story. It’s not just one institution. It’s a bunch of different trade associations. They changed over time. They merged. They formed new branches. Part of the challenge of writing the book was pulling all of these different elements together and trying to put them into some sort of coherent narrative.

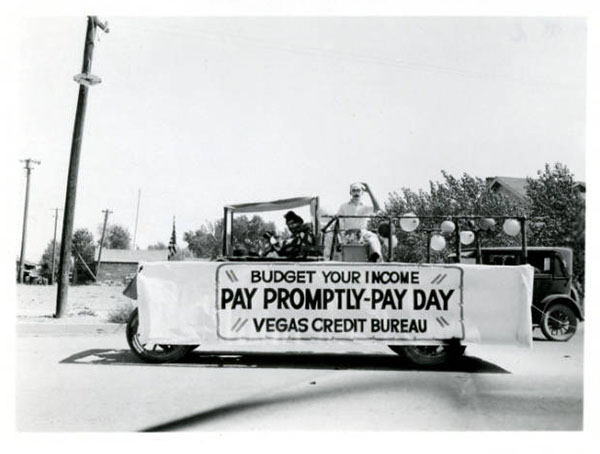

Photograph of the Vegas Credit Bureau parade entry, Las Vegas, circa late 1920s to early 1930s (image courtesy University of Nevada Las Vegas Library)

AWO: You show with a lot of detail that the development of the industry depended on a series of technological innovations, but you’re careful to avoid any sort of technological determinism in your interpretation of this history. Computers, for example, were adopted through managerial decisions about what human or machine capacities to prioritize. Could you say a bit about how it was decided to give computers the role they have in the industry?

JL: It’s undeniable that computing changed the whole industry. The important thing that I try to emphasize is that before computers, even though the credit professionals who did interviews with people applying for credit were using credit bureau information, when they sat down with applicants, they asked them questions and looked them up and down. There was a real sense that assessing creditworthiness was an art and relied on experience and intuition and a sort of mythical sixth sense that an experienced credit manager could have. Obviously, there were huge problems with this in terms of discrimination and injustice.

What I try to show is that credit professionals did not instantly just say, “Oh, computers! This is great. We will just let the technology make credit scores more statistical.” They resisted. They said, “You know, that sounds like gambling odds. How can you just add up someone’s creditworthiness?” Because creditworthiness is really about your willingness to pay, not just whether you have money. It is really a question about character and whether you are a good person. One of the themes in the book is that creditworthiness is really a moral category. It was in the past and I would argue that it still is.

The credit bureaus wanted to collect information about people’s personalities, and about their home lives and all of that sort of stuff, which was not really compatible with computers because back then computers didn’t have the same kind of memory or processing they have now. So they had to reduce the categories they used to determine creditworthiness. I think that was antithetical to the idea of collecting as much information as possible from any source possible.

AWO: The move from qualitative to quantitative criteria corresponds to the notion of the “democratization of credit” because math is supposed to be less biased than subjective assessments made by individuals with all their prejudices. Just now you said that you think that creditworthiness is still really a moral category. I assume the credit bureaus would disagree. After all, they just gather the information about us that’s available to them and combine it in various ways and run it through formulas.

JL: The credit bureaus are definitely not in the business of making moral judgments. The public is. There’s a popular understanding of creditworthiness. I think many people who have poor credit scores feel some sense of shame, whether it’s because they were blowing off their bills or because they were temporarily unemployed or got behind for completely legitimate reasons. But having a depressed credit score doesn’t mean you’re irresponsible as a human being, or not attentive to your responsibilities and your obligations.

There’s a definite moral stigma attached to having a lower credit score. If you watch the commercials for credit monitoring services, they’re always about a person who’s immature or irresponsible and foolish, the bumbling fool who doesn’t even know they have a credit score. It’s never about the upright citizen who’s aware of what’s going on. So this idea of democratization is really a double-edged sword because on the one hand credit scoring is more fair because of it. It doesn’t rely on the judgment of someone who is trying to decide whether or not I’m a good risk based on my personality.

But back when you got to meet with a credit manager, you at least got to tell your story if you did lose your job or got sick or got behind for some reason or if you got in an accident. Any of these things can happen to people. They don’t show up in your your credit score, which is just a number. None of the context is there.

AWO: The notion of the “democratization of credit” also reflects a belief that the credit bureaus were actually doing a morally beneficial service for the country, the idea being that it opened the possibility for any responsible, honest person to borrow money regardless of their position in the social hierarchy. Credit ratings didn’t care about wealth or class distinctions. The fact that American consumers were taking on more debt than ever was supposedly part of civilizational progress. That idea doesn’t seem to be as prevalent now.

JL: After 143 million people have lost their credit information, I don’t think anyone feels that credit rating is a wonderful service anymore, but the truth is that it is. We take for granted that you can go into a store and they’ll say, “Do you want to save 10% by opening an account?” You show your driver’s license and punch in your social security number, and voila—you get your discount; you get your card. We can’t have that world without some sort of information clearing house in the background.

Whether or not the current system is run well is an open question, but I think it would be hard to argue against it if certain requirements of justice and security were met, but they’re not met, unfortunately.

AWO: As someone with a historical perspective on the evolution of the credit bureaus, what do you think the consequences of this Equifax debacle are likely to be?

JL: That’s a good question. My concern is that there won’t be major consequences. Since the late 1960s, when the credit bureaus first came under scrutiny, there have been efforts to regulate them. The Fair Credit Reporting Act helped to do some of that, but over the years it has been very hard for consumers to get any sort of accountability or transparency. Consumers and policy makers had to fight just to get a little bit of help, like allowing people to get a free annual copy of their credit report.

This is a powerful industry and a lot of other industries are invested in the way that it does business, and I think it will be very difficult to make the situation change, to get the kinds of regulations that might help consumers.

We might think of what the credit bureaus do as services for consumers, but they’re not. The credit bureaus exist to serve business. Their whole job is to protect businesses from loss and to help them find good consumers. Their orientation is toward making sure credit card companies, mortgage companies, and other businesses have the data that they want, and not just credit information, but also other kinds of models and metrics that help them segment consumers and figure out who’s going to be most profitable for them. So I think that even under these circumstances, they’re happy to say, “We’re sorry, may we offer you some credit monitoring services?” But their main concern is not whether they are making us angry, because ultimately you can’t opt out. You can’t say, “Well, you know what? … I’m done with you Equifax; I’m going to take my data and go to TransUnion.” That’s not how it works.

AWO: They do market some products to consumers, but it seems these are mostly a way to sell repackaged information that they’re already selling to businesses.

JL: Exactly, yes. They make a lot of money now from these credit monitoring services. They’re not to fix your credit. They just alert you when a new account has opened or someone is trying to make an inquiry, and, like you said, it’s all just information they already have.

AWO: So what’s next? Where are you headed with your research?

JL: I’ve been thinking a lot about consumer ranking algorithms and credit scores. I’ll probably spend some time studying their history and their regulation. The development of credit bureaus and of credit scoring is in some ways the prehistory of our “big data” society. Credit bureaus were always big data institutions. Obviously, they weren’t always computerized, but they were always interested in collecting as much information as possible, and then using that information to make inferences, not just about your credit, but about your employability, whether you’d be a good tenant, whether you’d be a good insurance risk. I’ve been thinking about the history of our algorithmic culture and the credit reporting industry has obviously had a big role in that.

AWO: That’s an interesting point you make in your book: the credit bureaus were, in a sense, the vanguard of the information economy. They were the first to realize that information itself could be commodified.

JL: One of the fascinating things about the credit bureaus as an industry in the late 19th century is that, along with the insurance companies, they were ahead in collecting personal information and selling it. They were selling something that wasn’t a product; it was intangible. At that time, this wasn’t what people imagined businesses did. Businesses made things. They built railroads, they made steel, or they made sewing machines. Nobody else was selling information, especially not personal information.